QR Ph: Why Growing Businesses in the Philippines Can’t Afford to Ignore It

Table of Contents

For growing businesses, every sale matters. For businesses with growth on their mind, QR Ph isn’t optional anymore—it’s the smarter way to get paid.

QR Ph is the Philippines’ national standard for QR payments, designed to make transactions seamless for both businesses and customers. With one QR code, you can accept payments from any participating e-wallet or bank—no multiple QR codes, no awkward “Sorry, we only take GCash.”

1. Get Paid by Anyone, Anytime

As your customer base grows, so do their payment preferences. Limiting yourself to specific payment methods means losing the opportunity to maximize your sales.

With QR Ph, one QR code works for all. A small café can serve every customer without worrying about which app they use, and a neighborhood salon never has to turn away walk-ins just because they prefer paying through their bank.

Best practice: Display your QR Ph code prominently—on counters, tables, receipts, and even your social media—so customers can pay instantly without asking.

2. Speed Up Transactions and Simplify Operations

Growing businesses can’t afford slow lines or messy reconciliations. Handling cash creates friction—counting bills, giving change, and balancing the register at day’s end eats up time and invites mistakes.

QR Ph makes transactions instant and reliable. A karinderya can serve more customers during the lunch rush without fumbling for coins, and a busy convenience store can confirm payments in seconds while keeping lines moving.

Best practice: Check your payment notifications in real time so your staff can confirm payments and focus on serving customers faster.

3. Scale Without Extra Cost or Complexity

Expanding your business shouldn’t mean adding bulky machines or expensive card terminals. QR Ph lets you go cashless without the overhead—just print and display your QR code, and you’re ready to accept payments anywhere.

With QR Ph, a weekend market stall can start accepting digital payments immediately, and a multi-branch retailer can enable cashless checkouts across all locations without added equipment costs.

Here’s how QR Ph compares to other options:

Best practice: Track your QR Ph transactions through your provider’s dashboard to simplify daily reconciliation and focus on scaling your operations.

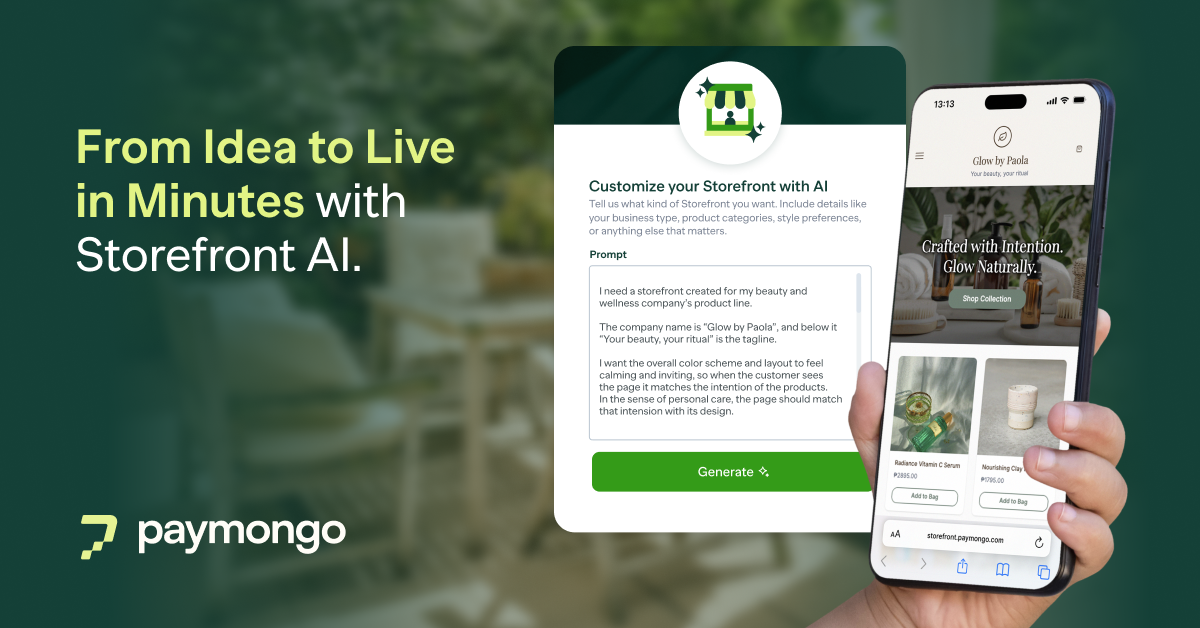

Why Growing Businesses Choose PayMongo for QR Ph

QR Ph is powerful, but PayMongo makes it effortless to use:

- Quick setup – Start accepting QR Ph payments in minutes.

- Unified dashboard – See all e-wallet and bank transactions in one place.

- Instant updates – Get notified the moment you’re paid.

For businesses that want to sell more, move faster, and grow with confidence, QR Ph through PayMongo isn’t just convenient—it’s a competitive edge.

Don’t Let Growth Pass You By

Thousands of Filipino SMEs are already growing with QR Ph. In a world where customers expect speed and simplicity, getting paid should never be the bottleneck.

👉 Sign up with PayMongo today and make getting paid the easiest part of running your business.

Subscribe to the PayMongo Blog

Join thousands of business owners in getting the latest financial insights